Understanding the SMART Framework

Before delving into the specifics of ESG goal-setting, let’s break down the SMART criteria:

Specific: Goals should be clear, precise, and well-defined. They should leave no room for ambiguity, ensuring that everyone understands the objective.

Measurable: Goals should be quantifiable, allowing for the tracking of progress. This involves defining metrics or key performance indicators (KPIs) to assess success.

Achievable: Goals should be realistic and attainable, considering the resources and capabilities of the organisation. While ambition is encouraged, setting unattainable goals can lead to frustration and disengagement.

Relevant: Goals should align with the organisation’s overall mission, values, and objectives. They should contribute to the broader purpose and reflect the specific ESG priorities of the business.

Time-bound: Goals should have a defined timeframe or deadline. This adds a sense of urgency and provides a structured timeline for achieving the desired outcomes.

Step 1: Identify ESG Priorities

Conduct a Materiality Analysis

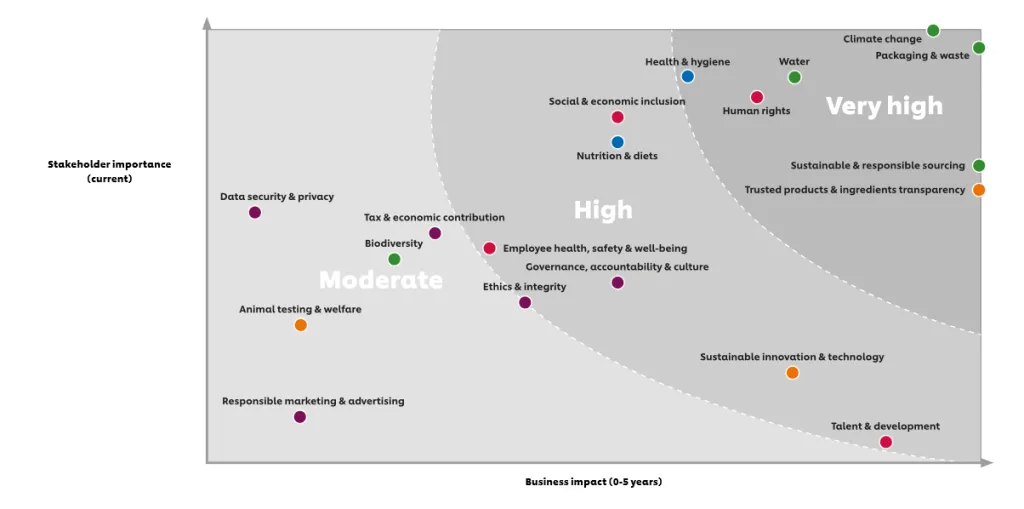

Stakeholders, both internal and external to your organisation, are polled to determine how important they feel ESG problems are. Materiality evaluations should include the perspectives of internal and external stakeholders to prevent bias and the omission of ESG subjects.

Concerns about environmental, social, and governance issues are summed up in the materiality assessment. It is not uncommon for businesses to take on projects on the fly or to neglect previously agreed-upon goals in favor of more pressing matters. Defining an ESG topic of interest to your company’s stakeholders may be challenging. Prioritization is facilitated by stakeholder input. We recommend combining impact screening with materiality assessment to zero in on the ESG threats and opportunities that will have the greatest impact on your business.

An example of the materiality matrix created by Unilever for the years 2019/2020. Topics to the far right are ones where the company has a great impact. The ones at the top are issues that stakeholders have evaluated as very important. The topics at the top right, then, are most relevant in terms of the company’s impact and stakeholder interest.

Understand your Current Position

Once you’ve decided on your top ESG priorities, it’s time to take stock of your company’s current programs, policies, metrics, and engagements.

We suggest starting with reports, policies, and data systems for general information, and then moving on to interviews with internal stakeholders for more in-depth knowledge. Establish clear objectives by conducting topic-focused working sessions, focusing on maintaining essential practices (KEEP), improving alignment with competitors and stakeholder needs (IMPROVE), and strategically optimizing efforts in one to three areas to achieve ESG market leadership (OPTIMIZE).

The results of this evaluation will give you a sense of the level of development of ESG practices throughout your whole organisation.

Step 2: Defining Specific and Measurable Goals

Once ESG priorities are identified, transform them into specific, well-defined goals. For example, if environmental sustainability is a priority, a vague goal like “reduce carbon emissions” can be refined into a specific goal such as “achieve a 20% reduction in carbon emissions by 2025 through energy-efficient practices and renewable energy adoption.”

Specific goals provide clarity, leaving no room for interpretation. They guide actions and decisions by outlining precisely what needs to be achieved.

Step 3: Establish Measurable Metrics

Measuring progress is essential for tracking the success of your ESG initiatives. Define key performance indicators (KPIs) or metrics associated with each goal. Using the previous example, measurable metrics could include the annual reduction in carbon emissions, percentage of energy sourced from renewable sources, or improvements in energy efficiency.

Measurable metrics not only help in monitoring progress but also provide tangible evidence of the impact your organisation is making in the realms of environmental, social, and governance practices.

Step 4: Ensure Achievability

While ambition is admirable, it’s crucial to set goals that are realistic and achievable. Consider the resources, expertise, and timeline required to meet each ESG goal. Assess the feasibility of your goals by evaluating the current state of your organisation and identifying any potential barriers or challenges.

For instance, if a social goal involves increasing employee diversity, ensure that the goal is achievable by implementing realistic hiring and retention strategies, promoting an inclusive workplace culture, and addressing any systemic barriers that may exist within the organisation.

Step 5: Align Goals with Relevance

Relevance is about ensuring that your ESG goals align with your organisation’s overall mission and values. Evaluate each goal in the context of your business and industry. If a particular goal does not contribute meaningfully to your organisation’s purpose or address significant ESG concerns, reconsider its inclusion in your strategy.

For example, if community engagement is a key ESG priority for your organisation, ensure that your social goals directly contribute to the well-being of the communities in which you operate.

Step 6: Set Time-bound Deadlines

Establishing a timeframe for achieving your ESG goals adds a sense of urgency and accountability. Set realistic deadlines for each goal based on the complexity of the objective and the resources available. Time-bound goals create a sense of structure and help in prioritizing initiatives.

Continuing with the previous examples, a time-bound aspect could be, “reduce carbon emissions by 20% by 2025” or “achieve a 15% improvement in employee diversity within the next three years.”

Step 7: Communicate and Engage Stakeholders

Transparent communication is crucial for the success of your SMART ESG goals. Clearly communicate your goals, metrics, and timelines to internal and external stakeholders. This transparency builds trust and fosters a sense of shared responsibility among employees, investors, customers, and the broader community.

Regularly engage with stakeholders to provide updates on progress, challenges, and successes. Seek feedback to ensure that your ESG goals remain aligned with evolving expectations and priorities.

Step 8: Monitor, Evaluate, and Adjust

The final step in the SMART ESG goal-setting process involves continuous monitoring, evaluation, and adjustment. Regularly assess progress against established metrics and analyze the effectiveness of your initiatives. If goals are consistently met, consider raising the bar to maintain momentum and drive further improvement.

You can start monitoring the progress through the use of ESG frameworks. To standardize the reporting and disclosure of ESG data, several organisations use what are called “ESG frameworks.”

There are a number of ESG frameworks to choose from, but one of the most popular is the Global Reporting Initiative (GRI) framework.

There are several other types of ESG frameworks you may choose from, including:

- CDP Guidance for Companies

- Climate Disclosure Standards Board (CDSB)

- Sustainability Accounting Standards Board (SASB)

- Science Based Targets initiative (SBTi)

Conversely, if challenges arise or certain goals prove to be unattainable, be open to adjusting them based on new information, changing circumstances, or stakeholder feedback. Flexibility and adaptability are essential in the dynamic landscape of sustainability.

Setting SMART ESG goals is a proactive and strategic approach to embedding sustainability into the core of your organisation. By identifying priorities, making goals specific and measurable, ensuring achievability and relevance, setting time-bound deadlines, communicating effectively, and continually monitoring progress, your organisation can navigate the complexities of ESG with purpose and precision. Embrace the journey towards sustainability, and let your SMART goals be the compass guiding your organisation towards a more responsible and resilient future.